- ❓ Introduction

- 📄 Step 1: Document and Report the Damage

- 📊 Documentation Essentials for Property Insurance Claims

- 🧑💼 Step 2: Contact Your Insurance Company

- 📊 Common Questions to Ask Your Insurer

- 🛠️ Step 3: Make Urgent Repairs and Keep Your Receipts

- 📊 Average Costs of Temporary Repairs in U.S. Homes

- 👷 Step 4: Hire a General Contractor With Insurance Experience

- 📊 Comparing General Contractors for Insurance Repairs

- ❓ FAQs About Property Insurance Claims

- ⭐ Final Thoughts

❓ Introduction

What would you do if a storm ripped off part of your roof tonight or a burst pipe flooded your living room tomorrow? I’ve asked myself that question before, and the answer isn’t always clear. Many homeowners believe their insurance will take care of everything, but the reality is that claims often get delayed or underpaid because critical steps are missed. Filing a property insurance claim the right way is not just about reporting the damage—it’s about documenting, communicating, and protecting your investment from the start. Below, I’ll break down the 4 essential steps you should follow to file a successful property insurance claim.

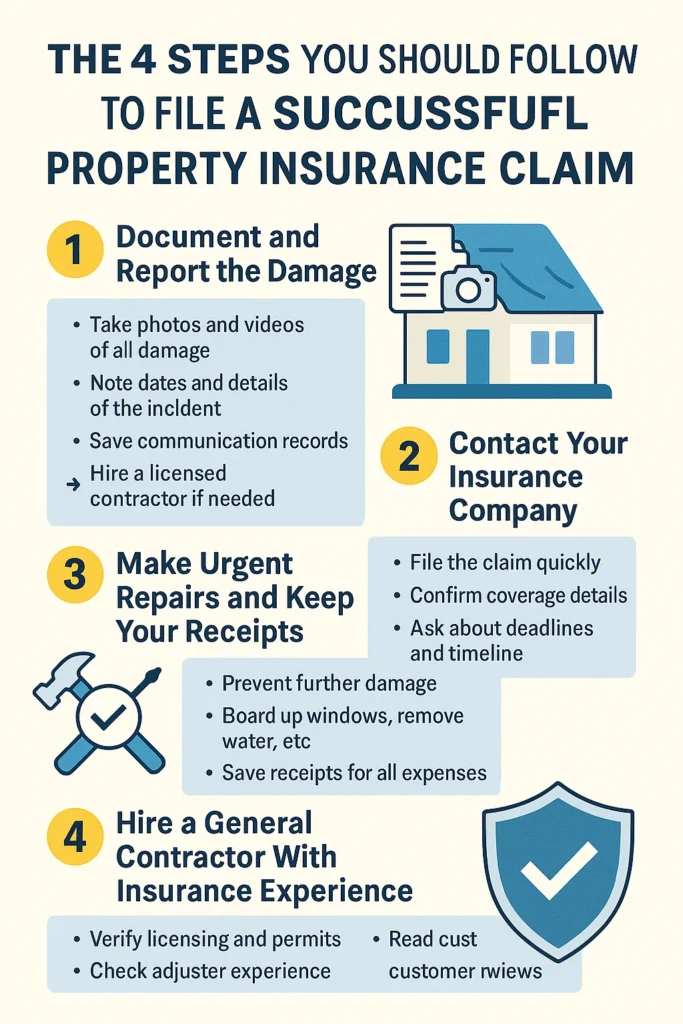

📄 Step 1: Document and Report the Damage

The first and most important step is evidence collection. Without proof, your claim may not get the payout you deserve.

What You Should Do:

- Take clear photos and videos of all visible damage (roof, siding, windows, walls, furniture, etc.).

- Record timestamps and dates for each piece of evidence.

- Write down a summary of events, including when and how the damage happened.

- Save copies of emails, letters, and call logs with your insurance company.

📊 Documentation Essentials for Property Insurance Claims

| Evidence Type 📑 | Why It Matters ⭐ | Example Action ✔️ |

|---|---|---|

| Photos & Videos | Provides visual proof of damage | Capture wide & close shots |

| Written Notes | Records timeline & details | Note time of storm/flood |

| Communication Records | Protects against disputes | Save adjuster emails |

| Contractor Estimates | Strengthens claim value | Request written inspection |

➡️ If the damage is significant, hire a licensed contractor or public adjuster to professionally assess the full extent of the loss. This ensures nothing is overlooked.

🧑💼 Step 2: Contact Your Insurance Company

Once you’ve documented the damage, notify your insurer immediately. Delays can weaken your claim.

Key Actions:

- Call your insurance company or use their official mobile app to start the claim.

- Confirm whether the event is covered under your policy.

- Ask about the deadline for filing claims (varies by provider).

- Request an estimated timeline for the process.

📊 Common Questions to Ask Your Insurer

| Question ❓ | Why It’s Important ⭐ |

|---|---|

| Is this damage covered by my policy? | Avoids false assumptions |

| How long do I have to file? | Prevents missed deadlines |

| Will temporary housing be covered? | Prepares for living costs |

| How long will the process take? | Helps plan repairs |

➡️ Being proactive shows your insurer that you’re serious and informed, which often leads to a smoother claim process.

🛠️ Step 3: Make Urgent Repairs and Keep Your Receipts

Most homeowners insurance policies require you to prevent further damage after an incident. Failing to act may give insurers a reason to deny part of your claim.

What to Do Immediately:

- Cover damaged roofs with tarps to stop water leaks.

- Board up broken windows to secure your home.

- Remove standing water if safe to do so.

- Keep receipts for every emergency repair and temporary housing cost.

📊 Average Costs of Temporary Repairs in U.S. Homes

| Repair Type ⚒️ | Average Cost 💲 | Why It Matters ⭐ |

|---|---|---|

| Roof tarp installation | $500 – $1,200 | Stops interior water damage |

| Window boarding | $200 – $600 | Prevents theft & weather damage |

| Water extraction | $1,000 – $4,000 | Reduces mold growth |

| Temporary housing | $100 – $200/day | Provides safe living space |

➡️ Save every receipt. If your policy includes Additional Living Expenses (ALE) coverage, you may be reimbursed for hotel stays, meals, and even laundry.

👷 Step 4: Hire a General Contractor With Insurance Experience

Once your claim is moving forward, you’ll need a qualified general contractor to restore your home. Choosing the right professional is critical to ensure quality work and fair compensation.

What to Look For:

- Proper licenses and permits for local building codes.

- Experience working with insurance adjusters.

- Verified reviews and references from past clients.

- Willingness to coordinate with a public adjuster if needed.

📊 Comparing General Contractors for Insurance Repairs

| Criteria 📑 | What to Check ✔️ | Why It Matters ⭐ |

|---|---|---|

| Licensing & Permits | Ask for state license numbers | Ensures legal compliance |

| Insurance Knowledge | Past work with insurance claims | Faster approvals |

| Customer Reputation | Online reviews, testimonials | Builds trust & reliability |

| Adjuster Collaboration | Works with public adjusters | Maximizes claim settlement |

➡️ A contractor with insurance claim experience ensures that repairs meet code requirements and that your insurer doesn’t underpay your settlement.

👉 For expert support, visit Akron Roofing Experts for professional guidance on storm damage repair and insurance claim assistance.

❓ FAQs About Property Insurance Claims

⭐ Final Thoughts

Filing a property insurance claim is not just about paperwork—it’s about being prepared, detailed, and proactive. By following these 4 steps—documenting damage, contacting your insurer, making urgent repairs, and hiring a qualified contractor—you protect both your finances and your home. Each step builds a stronger case, leading to a higher chance of full compensation.